Table of Contents

What Is Proof Of Address? Why is Proof of Address Important?

While the term is pretty self-explanatory, proof of address (PoA) is more than what it sounds. It refers to a document that shows where you live, but the process is essential for identity verification as a security measure against fraud.

For example, from a traditional banking perspective, you’re required to prove your residence because banks need to make sure that you’re not lying about the place you live. In the digitalized era, it’s now common to ask for address proof during the identity verification stage when creating a new account online.

We created this post to give you a clear idea about what is Proof of Address (PoA), how does it work, what kind of documents would be considered as Proof of Address, and finally, why Proof of Address is important in digital world?

How Exactly Does It Work?

Proof of Address verification, as the whole identity verification process, complies with Know Your Customer (KYC) requirements as well as Anti-money Laundering (AML) rules. As an extra step, you can be required not only to submit your government-issued document but also your proof of address during the identity verification. This additional documentation check minimizes the risks of fraud during the customer onboarding process.

You can be asked to upload your proof of address when performing a transaction. Even though local and international legislation requires ID and address verification, it’s not as simple as it looks at first glance. Over the years, forged documents have become a major issue in terms of security. That’s why businesses need to stick to the rules and regulations to conduct proper security checks.

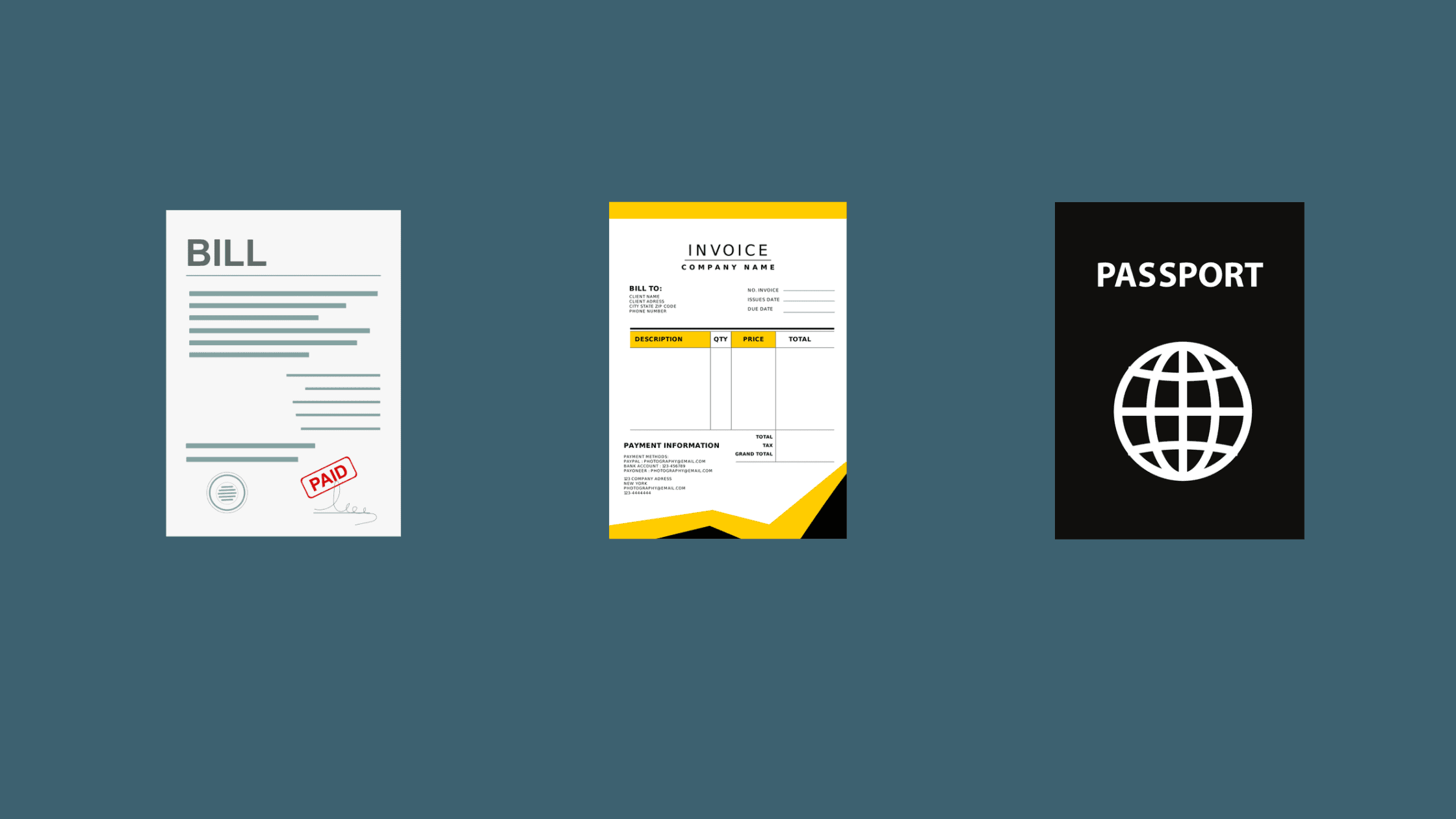

What Kind of Documents Count as PoA?

There’s a great chance that you have at least one acceptable proof of address document. You can check your email inbox; most probably, you’ll find some sort of utility bill, at least one bank statement, or a notification regarding a new invoice from an internet provider.

The most important part for customers is to keep the address up to date and notify banks and other institutions in case the data changes. Of course, each company has its own guidelines when it comes to security checks, but the most common documents for PoA verification are:

Bank statements

Utility bills

Credit card statements

Residence permits or certificates

Tax documents

Insurance statements

Official salary documents

Driver License

Passport

For example, the utility bill must be issued in one’s name to match the government-issued identification. Also, the submitted document needs to have a date (usually, it’s three months) for validity reasons. Since the system isn’t flawless, someone with bad intentions could reproduce and forge the mentioned documents.

Why is Proof of Address Important?

Additional documentation and data collected during the proof of address verification add an extra layer of security. The verification shows if the user is who he says he is. This risk assessment also discovers users who are from a high-risk country, preventing them from creating an account during the customer onboarding process.

Some brokerages and financial institutions automatically eliminate users from high-risk countries; therefore, proof of address verification serves a clear purpose when you want to assess all of the customers and check their location.

As required by the KYC policy, proof of address checks the validity of the location and ensures that the address is up to date. We’ve listed the main benefits below:

1. A Valuable Security Measure

According to the Federal Trade Commission, someone becomes a victim of identity fraud every 14 seconds. The numbers quadrupled due to the global pandemic, including more cases of banks and credit unions losing money to synthetic identity fraud. To mitigate fraud and reduce the losses due to non-compliance, one of the primary methods used in different industries is customer identity verification. That’s why it’s also a vital step in this process to learn about proof of address verification and its benefits.

Proof of Address verification has several ways of use, for example, customers need to verify their identity and have their addresses checked when opening a new bank account, signing up for digital banking services or when applying for a mortgage. To reduce such fraud, borrowers need to provide certain documents to lenders for verification. That said, digital banks don’t have physical branches, that’s why their services are available 24/7 online, which gives endless possibilities for scammers.

Proof of Address verification is valuable, as it allows finding out the location of companies’ customers. For fraud prevention, businesses can also impose restrictions on their clients within a specified geographic area. Such a technique can be impacted by compliance with a specific geographical law or simply caused by company policy.

2. Universal For Many Industries

Since the digital sphere is now bigger than just online banking, other industries use similar security measures. For instance, digital marketplaces, online gaming, cryptocurrency market, FinTech, or eCommerce stores also need to ensure that the customers are who they claim to be. Online platforms with money flowing are exposed to various security risks and money laundering.

For example, over the global pandemic, Airbnb has received an increased number of fraudulent bookings. The scheme involves multiple customers getting scammed out of housing properties. Avoiding proper Proof of Address verification might lead to no good. Fraudsters could upload any property listing supposedly available for renting and trick users when they try to sign up.

Proof of Address and Compliance

Fraud causes huge losses to many businesses and the whole world’s economy. Businesses can add multiple verification methods to their security package to comply with regulations. But let’s be real. Security threats can’t be eliminated completely. Despite that, they can be identified by following regulations which are designed to minimize risks and avoid legal damage with a smooth and optimum user experience.

Some locations or specific industries have stricter rules due to the higher risk of fraud. For example, in the USA, some states require stronger proof of address verification where online gambling is legal. Otherwise, in these types of situations, without ID and Proof of Address verification, the business can expect hefty fines.

Final Thoughts

It’s no secret that using an AI-enabled identity verification solution helps detect altered documents to reduce fraud. However, with scammers becoming more advanced, many businesses are still losing money on fraud. Thankfully, advanced technological solutions help tackle the alarming issues of online criminal activity. Businesses today tend to add an extra layer of protection with automated proof of address verification tools to comply with the demands of local or global regulations easier.

We hope this post would help you learn about what is Proof of Address (PoA), how does it work, what kind of documents would be considered Proof of Address, and finally, why Proof of Address is important in the digital world? Thanks for reading this post. Please share this post and help to secure the digital world. Visit our social media page on Facebook, LinkedIn, Twitter, Telegram, Tumblr, Medium & Instagram, and subscribe to receive updates like this.

Creator – Domantas Ciulde

You may also like these articles:

Arun KL

Arun KL is a cybersecurity professional with 15+ years of experience in IT infrastructure, cloud security, vulnerability management, Penetration Testing, security operations, and incident response. He is adept at designing and implementing robust security solutions to safeguard systems and data. Arun holds multiple industry certifications including CCNA, CCNA Security, RHCE, CEH, and AWS Security.